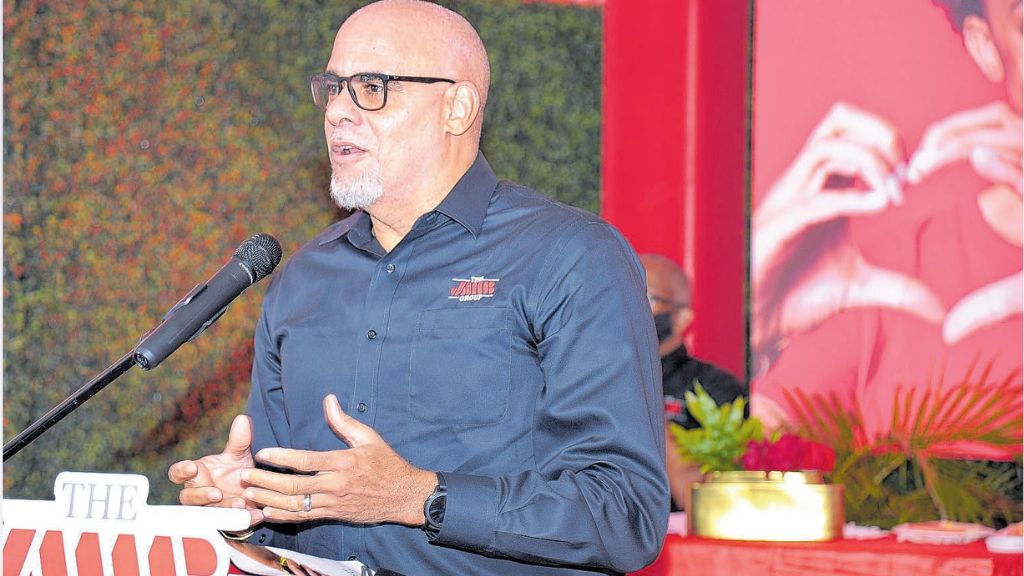

Jamaican financial institutions are pressing regulators to synchronize the implementation of new capital and liquidity regulations, citing the rapid pace of reforms as a significant compliance burden that could erode profitability. Keith Duncan, CEO of JMMB Group Ltd, one of Jamaica’s largest financial entities, emphasized this concern during the company’s 12th annual general meeting (AGM) on Friday. Duncan highlighted that over 100 policy reforms have been introduced in the past decade, creating substantial operational challenges for the sector. While these measures aim to enhance financial stability, their accelerated rollout has strained resources, particularly for smaller institutions. The Bank of Jamaica (BOJ) is currently advancing a series of reforms, including Basel III capital standards, a ‘twin peaks’ regulatory model, and new liquidity requirements for financial holding companies (FHCs). These changes, though beneficial in the long term, are driving up costs and limiting capital deployment flexibility. Duncan urged regulators to adopt a collaborative approach, ensuring reforms are sequenced to minimize the burden on the industry. The BOJ is also developing a special resolution regime (SRR) to address failing financial institutions, though its funding mechanism remains contentious. Additionally, the Financial Services Commission (FSC) has introduced reforms to exposure limits for collective investment schemes and dividend declarations by securities dealers. While these measures aim to strengthen the financial system, they may lead to higher compliance costs, potentially passed on to consumers. The JMMB Group CEO called for a balanced regulatory framework to safeguard profitability and shareholder returns.

标签: Jamaica

牙买加

-

Kim Kardashian’s new faux pubic hair underwear sold out

Kim Kardashian’s latest venture into provocative fashion has sparked both controversy and commercial success. Within 24 hours of its release, her Skims faux hair micro string thong, dubbed ‘The Ultimate Bush,’ sold out completely. The 44-year-old reality star unveiled the daring product line on Tuesday, promoting it as Skims’ “most daring panty yet.” The launch was accompanied by a video on Instagram, captioned, “Just dropped: The Ultimate Bush. With our daring new faux hair panty, your carpet can be whatever colour you want it to be.” Despite the immediate backlash from social media users, who questioned the necessity and practicality of the product, it quickly became unavailable. Priced at US$34.97, the thong now has a waitlist as of Wednesday. Critics took to platforms like X (formerly Twitter) to express their disbelief, with one user humorously asking, “Do we wash this in the washer or use shampoo and conditioner lmao?” Another commented, “Girlies how is this sold out?! We can grow out our bush for free.” The product’s rapid sell-out highlights the polarizing yet impactful nature of Kardashian’s brand.

-

Chaka Demus returns with festive new single

Few figures in reggae and dancehall music command as much recognition as Chaka Demus. For over three decades, his distinctive voice and style have shaped an era of Jamaican music that has resonated globally. Now, the legendary artist is embarking on a new chapter, infusing the holiday season with the warmth of reggae through his latest release, *Christmas Time*. This track masterfully combines the festive joy of the holidays with the unmistakable rhythm of Jamaican beats, creating a folksy yet contemporary anthem ideal for family gatherings, community festivities, and global holiday playlists. Born John Taylor, Chaka Demus emerged from Kingston’s vibrant sound system culture, quickly establishing himself as a deejay with a commanding stage presence and a knack for infectious rhythms. His early work with Roots Majestic and King Jammy’s sets laid the foundation for a career that would see him transition from selector to artiste. Hits like *Everybody Loves Chaka*, *Young Gal Business*, and *Gal Wine* solidified his status in Jamaican music, with the latter remaining a fan favorite at live performances. His breakout single, *Original Kuff*, became a defining track of the digital dancehall era, earning him widespread acclaim both locally and internationally. Collaborating with top producers such as Bobby Digital and Winston Riley, Chaka Demus secured his place as one of Jamaica’s most versatile musicians by the 1990s. His partnership with singer Pliers marked a historic milestone, as the duo Chaka Demus & Pliers became household names with hits like *Murder She Wrote*, *Tease Me*, and their chart-topping rendition of *Twist and Shout*. They made history as the first Jamaican act to achieve five consecutive UK Top 20 singles, paving the way for dancehall and reggae to flourish in mainstream pop markets. Their music, celebrated for its feel-good vibes and Caribbean soul, continues to dominate global playlists, with *Murder She Wrote* remaining one of the most sampled and revered reggae tracks worldwide. Beyond his success with Pliers, Chaka Demus has continued to innovate and perform, cementing his legacy as a cultural ambassador for Jamaican music. Earlier this year, he released the single *Mi Love You*, showcasing his enduring creativity and reaffirming his artistic prowess. *Christmas Time* is now available worldwide on major streaming platforms, including Spotify, Apple Music, YouTube, and Audiomack. With his unmistakable voice, timeless charisma, and global influence, Chaka Demus once again demonstrates that great artistry transcends time.

-

Jamaica’s inflation rises by 0.8% in September, driven by food and housing

KINGSTON, Jamaica — Jamaica’s consumer prices surged by 0.8 per cent in September, according to the Statistical Institute of Jamaica (STATIN). This increase, driven by escalating costs in food, housing, and education, has elevated the annual point-to-point inflation rate to 2.1 per cent for the period spanning September 2024 to September 2025. The education sector witnessed the most pronounced monthly price hike, soaring by 5.6 per cent, primarily due to higher tuition fees at private primary schools as the new academic term commenced. The housing, water, electricity, gas, and other fuels category also saw a 1.0 per cent rise, reflecting increased electricity rates and rental expenses. Food and non-alcoholic beverage prices climbed 0.9 per cent, largely influenced by higher costs for agricultural produce such as sweet potatoes, tomatoes, carrots, and cabbages. Over the twelve months leading to September 2025, the housing division and restaurant and accommodation services were the primary contributors to the 2.1 per cent inflation rate, with increases of 4.8 per cent and 4.1 per cent, respectively. Food and non-alcoholic beverages experienced a more modest annual rise of 0.7 per cent. Regional disparities in inflation were evident, with the Greater Kingston Metropolitan Area recording the highest monthly increase at 1.0 per cent, compared to 0.8 per cent in other urban centres and 0.6 per cent in rural areas. Additional sectors facing upward pressure included transport, which rose 0.3 per cent due to higher petrol prices and toll fees, and personal care goods and services, which increased by 0.5 per cent. These rises were partially mitigated by stability or deflation in other categories. The information and communication division remained unchanged for the month but declined by 5.8 per cent year-on-year, while insurance and financial services showed no monthly or annual variation. The Consumer Price Index (CPI), which tracks changes in the general level of prices for goods and services purchased by households, underscores the ongoing economic challenges faced by Jamaican consumers.

-

Jamaica eyes new port in St Thomas to tap Guyana’s building boom

The Port Authority of Jamaica (PAJ) is actively considering the development of a new export port in St Thomas, a strategic move aimed at positioning Jamaica as the leading supplier of construction materials across the Caribbean. This initiative is particularly targeted at Guyana, where an oil-driven infrastructure boom has created unprecedented demand for aggregates, limestone, and cement. PAJ Chairman Alok Jain revealed these plans during a recent address at the Institute of Chartered Accountants of Jamaica (ICAJ) annual business conference, emphasizing the need for additional ports to meet regional demands. While a specific timeline remains undisclosed, Jain highlighted the importance of locating ports near mining sites to minimize transportation costs and logistical challenges. The St Thomas port is envisioned as a dedicated bulk export facility, designed to streamline the movement of heavy materials to regional buyers. This development aligns with Prime Minister Andrew Holness’s March 2023 call for local quarry operators to expand production to serve Caribbean markets, particularly Guyana. Guyana’s infrastructure projects have surged in recent years, driven by its oil wealth, leading to a 250% increase in gravel and crushed stone imports in 2023, totaling $47 million. While Suriname’s State-owned Grassalco has been a primary supplier, Guyana has also sought materials from Jamaica and other Caribbean nations. The proposed St Thomas port is part of a broader strategy to transform Jamaica into a global logistics hub, with Jain envisioning the island as the fourth global logistics node after Singapore, Dubai, and Rotterdam. This ambition is supported by significant investments in Jamaica’s port infrastructure, including over $400 million in the Kingston Freeport Terminal since 2016 and the development of the Caymanas Special Economic Zone, a modern logistics and light-manufacturing hub. Jain believes that shifting global trade dynamics, including tariff upheavals and supply chain disruptions, present a unique opportunity for Jamaica to leverage its geographic advantage and emerge as a key player in international trade.

-

Warmington wants gov’t to take full responsibility for housing scheme roads

KINGSTON, Jamaica — Everald Warmington, Member of Parliament (MP) for St Catherine South Western, has urged the Jamaican Government to assume full responsibility for the maintenance of roads in housing schemes, particularly those constructed four to five decades ago, which are now in a state of severe disrepair. Warmington presented a motion to this effect in the House of Representatives on Tuesday, aiming to establish this as official Government policy if debated and approved.

-

VMIL aims AI at cost and service goals in digital overhaul

VM Investments Limited (VMIL) is spearheading a digital revolution in its operations, leveraging artificial intelligence (AI) and advanced technologies to enhance efficiency and expand its regional footprint. Through a strategic partnership with overseas technology firm Abacus, VMIL is integrating AI into its call-center functions, research, and risk management teams, automating routine tasks to free up human resources for higher-value advisory roles. This initiative aligns with a broader industry trend, as global financial institutions like Citi are rapidly adopting generative AI to gain a competitive edge. Alison Mais, VMIL’s Chief Operating Officer, emphasized the importance of a digital-first approach, stating that 58% of clients now use the company’s core client management system, with 90% of equity transactions conducted on the J-Trader platform. These platforms provide real-time access to statements, rates, and transaction capabilities, replacing outdated manual communication channels. VMIL’s digital infrastructure is also facilitating its expansion into the Eastern Caribbean, with a recently approved investment advisory license in Barbados enabling virtual client onboarding. This strategy allows the company to serve regional clients efficiently without the need for physical presence, reducing costs while maintaining compliance and governance standards. Despite significant upfront investments in technology, VMIL views AI adoption as essential for long-term competitiveness. The company reported a 31.6% rise in second-quarter revenue to $653.8 million, driven by growth in fees and investment gains, though it posted a net loss of $6.7 million due to increased operating expenses from its digital transformation. CEO Rezworth Burchenson highlighted the importance of technology in product development and revenue diversification, pointing to the growth of VMIL’s asset management platform, which now includes unit trusts, mutual funds, private portfolios, and alternative investments like real estate and private equity. The company’s digital transformation is central to its strategy of building a scalable, modern financial services platform that meets the evolving needs of regional and diaspora clients. VMIL’s aggressive digital push positions it at the forefront of a transformative trend in the financial sector, mirroring the strategies of global institutions like Citi. By embedding AI and digital tools into its operations, VMIL aims to drive efficiency, manage risk, and ensure profitable growth in a rapidly changing market.

-

Trump’s H-1B visa fee hike could send Jamaican professionals to other countries

The Donald Trump administration’s decision to impose a staggering $100,000 application fee for employers seeking to hire foreign professionals through the H-1B visa programme has raised significant concerns among immigration experts. Immigration attorney Dayle Blair warns that this move could ‘backfire’ on the US, potentially driving skilled workers to countries like Canada and China, which are actively courting global talent in fields such as information technology, engineering, healthcare, and education. Blair highlighted China’s recent introduction of the K-Visa, a sponsor-free visa category aimed at attracting STEM professionals, as a direct response to the US’s restrictive measures. The K-Visa, launched on October 1, 2025, is part of China’s broader strategy to compete for skilled workers, though details on fees and requirements remain undisclosed. Blair also noted that remote work could offer an alternative for US employers, but concerns over data security and client permissions persist. The H-1B visa, which allows US employers to hire foreign workers in specialised fields, has seen a 20-fold fee increase from $5,000 to $100,000, effective September 21, 2025. This sharp rise comes as the US government pushes for companies to hire more local talent. However, Blair and other experts argue that this policy could stifle US innovation and businesses by restricting access to a global talent pool. Smaller companies, in particular, may struggle to afford the new fee, potentially limiting their ability to hire skilled foreign workers. The announcement has already caused widespread concern among employers, with many scrambling to bring employees back to the US before the deadline. Additionally, Jamaicans are being warned to remain vigilant against scams that often arise during periods of immigration uncertainty. Immigration attorney Nadine Atkinson-Flowers urged individuals to rely on credible sources and make informed decisions to avoid falling victim to fraudulent schemes.

-

Margaritaville Caribbean’s IPO plans remain distant prospect

Margaritaville Caribbean Group has indicated that its plans for an initial public offering (IPO) of its Jamaica business remain uncertain, with Chairman Ian Dear declining to provide a specific timeline. The IPO, first proposed in 2023, was intended to raise between US$4 million and US$5 million for expansion through a listing on a major regional exchange. However, Dear emphasized that the IPO remains in the company’s “very near future” but offered no concrete updates.

Margaritaville Caribbean operates three flagship locations in Jamaica—Ocho Rios, Montego Bay, and Negril—which have faced significant operational challenges in recent years. These include pandemic-related disruptions and storm damage at the Montego Bay venue, which was temporarily out of commission but has since partially reopened. Dear expressed optimism, stating that the Montego Bay location is “back on track” and expected to be fully operational by the end of the year. Additionally, the damaged cruise pier in Ocho Rios, crucial for customer traffic, is anticipated to reopen soon, potentially boosting revenues.

Despite the IPO delay, Dear highlighted the group’s strong operational performance, particularly in its listed subsidiary, Margaritaville (Turks) Ltd. For the year ending May 31, 2025, the subsidiary reported a net profit of US$1.6 million, a 137% increase from the previous year, driven by a 22% revenue growth to US$9.6 million. The gross profit margin also expanded to 70.9%, reflecting improved financial management. However, cash flow challenges persist, with net cash from operations at just US$264,673, largely due to a US$2.43-million increase in the “Due from related companies” segment, now the largest asset on the subsidiary’s balance sheet.

Dear remains optimistic about the group’s prospects, stating, “We are very bullish on Jamaica. We see that our tourism product is growing… all of our locations in Jamaica are doing quite well now.” The focus remains on operational recovery and financial discipline as the group navigates its path forward.

-

Candidates, contributors campaign financing submissions due Wednesday

KINGSTON, Jamaica – The Electoral Commission of Jamaica (ECJ) has issued a reminder to all candidates who participated in the September 3, 2025, General Election, emphasizing that the deadline for submitting their election expense reports is Wednesday. According to the Representation of the People Act (ROPA), candidates or their official agents are legally obligated to file the Return of Election Expenses within six weeks following Election Day. The submission must be made using the prescribed Form 22, and the law caps election spending at a maximum of $15 million per candidate. Additionally, contributors to election campaigns are also mandated to provide their legally required declarations by the same deadline. These documents must be submitted to the returning officer of the respective constituency or directly to the Director of Elections at 43 Duke Street, Kingston, addressed to the Legal Affairs and Compliance Department. Once the submissions are received, the ECJ will compile and publish a summary of the declarations provided by the candidates.